Introduction:

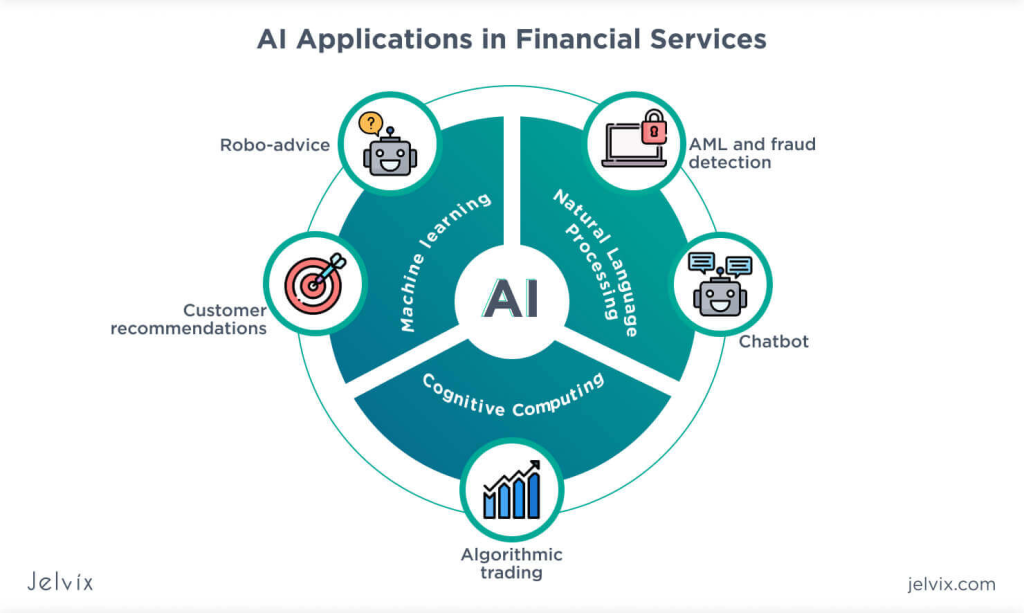

Financial planning is a critical aspect of achieving long-term financial goals and ensuring a stable future. Recent advancements in artificial intelligence (AI) have transformed the financial industry, providing powerful tools that assist individuals in making informed investment decisions. AI-assisted financial planning tools leverage data analysis, machine learning, and predictive algorithms to offer personalized and actionable investment advice. This tutorial explores the benefits of AI-powered financial planning tools and how to utilize them for making smarter investments.

Section 1: Understanding AI-Assisted Financial Planning

1.1 Definition of AI-Assisted Financial Planning

AI-assisted financial planning involves the integration of artificial intelligence and machine learning algorithms into traditional financial planning processes. It helps investors make data-driven decisions by analyzing vast amounts of information and offering personalized recommendations based on individual financial goals and risk tolerance.

1.2 Advantages of AI-Powered Tools in Financial Decision-Making AI-powered tools enhance financial decision-making by:

- Processing and analyzing vast amounts of data quickly and accurately.

- Providing personalized investment advice tailored to an individual’s unique financial situation and objectives.

- Continuously learning from market trends and historical data to improve investment strategies over time.

- Offering real-time monitoring and alerts to respond promptly to market changes.

- Reducing human biases and emotions that can impact investment decisions.

1.3 Benefits of AI-Assisted Financial Planning The benefits of AI-assisted financial planning include:

- Enhanced investment performance through optimized asset allocation and portfolio diversification.

- Improved risk management with real-time monitoring and automated adjustments to market conditions.

- Cost-effectiveness compared to traditional financial advisors, making it accessible to a broader audience.

- Convenient and user-friendly interfaces for investors to access their financial information anytime, anywhere.

- Greater transparency and control over investment decisions.

Section 2: Exploring AI-Powered Investment Platforms

2.1 Robo-Advisors: The Future of Investment Management

Robo-advisors are automated investment platforms that use AI algorithms to create and manage investment portfolios based on an investor’s risk profile and financial goals. They offer an affordable and hands-off approach to investing, making them popular among both novice and experienced investors.

2.2 Features and Functions of Robo-Advisory Platforms Robo-advisory platforms typically offer the following features:

- Onboarding process to assess an investor’s risk tolerance, financial goals, and time horizon.

- Algorithm-based asset allocation to build a diversified portfolio aligned with the investor’s preferences.

- Automated portfolio rebalancing to maintain the desired asset allocation over time.

- Tax-efficient strategies to optimize returns and minimize tax liabilities.

- Performance tracking and reporting to keep investors informed about their portfolio’s progress.

2.3 Choosing the Right Robo-Advisor for Your Investment Goals When selecting a robo-advisor, consider factors such as:

- Fees and charges associated with the platform.

- Investment strategies and asset allocation models offered.

- Integration with existing financial accounts and services.

- Reputation and track record of the robo-advisor in the market.

Section 3: Getting Started with AI-Assisted Financial Planning

3.1 Identify Your Financial Goals and Risk Tolerance

Before using AI-powered financial planning tools, clearly define your financial goals, such as retirement, buying a home, or funding education. Assess your risk tolerance to determine your comfort level with potential investment fluctuations.

3.2 Create a Comprehensive Financial Profile

Gather all relevant financial information, including income, expenses, assets, debts, and existing investments. A comprehensive financial profile provides a clear picture of your current financial standing and helps the AI tool offer personalized recommendations.

3.3 Link Your Investment Accounts with the AI Platform

Connect your investment accounts, bank accounts, and other financial instruments with the AI-powered platform. This allows the tool to access real-time data and provide accurate insights for your investment strategy.

Section 4: AI-Driven Portfolio Management

4.1 Diversification and Asset Allocation Strategies

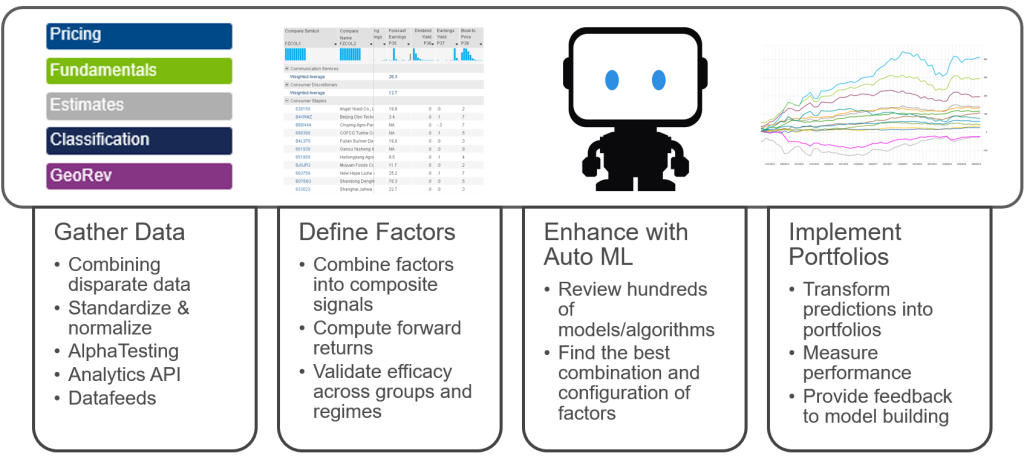

AI-assisted portfolio management emphasizes diversification across different asset classes, reducing the overall risk exposure. The platform’s algorithms optimize asset allocation based on market conditions and your risk profile to achieve a balance between growth and stability.

4.2 Portfolio Rebalancing and Tax Optimization

An AI-powered platform automatically rebalances your portfolio to maintain the desired asset allocation. Additionally, it employs tax-efficient strategies such as tax-loss harvesting to minimize tax liabilities and maximize after-tax returns.

4.3 Leveraging AI for Risk Management

AI tools continuously monitor market conditions and potential risks. They respond promptly to sudden market changes, helping you adjust your portfolio to mitigate risks and safeguard your investments.

Section 5: Utilizing Machine Learning for Investment Insights

5.1 Analyzing Market Trends and Predicting Performance

AI algorithms analyze historical market data to identify patterns and trends. They can predict market performance, helping you make informed investment decisions based on data-driven insights.

5.2 Identifying Investment Opportunities with AI Algorithms

AI-powered platforms scan the market for investment opportunities that align with your financial goals and risk profile. These platforms can identify undervalued assets, emerging trends, and potential growth opportunities.

5.3 Incorporating Economic and Industry Indicators into Investment Decisions

AI tools consider various economic and industry indicators to gauge market sentiment and identify potential risks and opportunities. They use this information to adjust your investment strategy accordingly.

Section 6: Monitoring and Tracking Investments with AI

6.1 Real-Time Performance Tracking

AI-assisted platforms offer real-time tracking of your investment performance. You can access up-to-date information about your portfolio’s progress and track how it aligns with your financial goals.

6.2 Automated Reporting and Investment Updates

AI platforms generate automated reports and investment updates, providing you with a comprehensive overview of your investment performance, recent activities, and future projections.

6.3 Customizable Alerts and Notifications

Stay informed about critical market developments and portfolio changes through customizable alerts and notifications. These notifications help you act promptly when required, keeping your investment strategy on track.

Section 7: Understanding the Role of Human Advisors

7.1 Combining Human Expertise with AI-Assisted Tools

While AI tools provide valuable insights, human financial advisors can offer personalized advice and guidance tailored to your unique financial situation, goals, and preferences.

7.2 How to Benefit from Hybrid Advisory Services

Consider seeking services that offer a hybrid approach, combining the benefits of AI algorithms and human expertise. This way, you can benefit from the best of both worlds to optimize your investment strategy.

7.3 Addressing the Importance of Emotional Investing

AI-powered tools can help mitigate emotional biases that influence investment decisions. However, it is crucial to remain mindful of emotions during turbulent market conditions and seek professional advice when needed.

Section 8: Managing Risks and Limitations

8.1 Data Security and Privacy Concerns

Choose AI platforms that prioritize data security and privacy. Ensure that the platform complies with industry regulations and maintains robust security measures.

8.2 Dealing with Volatile Market Conditions

AI algorithms are designed to adapt to changing market conditions, but market volatility can still impact investments. Have a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations.

8.3 Being Mindful of AI-Driven Biases and Limitations

While AI algorithms are powerful, they are not immune to biases and limitations. Stay informed about the underlying algorithms and their potential biases, and cross-verify their recommendations with other sources.

Section 9: Best Practices for Successful AI-Assisted Financial Planning

9.1 Regular Review and Adjustments

Periodically review your investment strategy and financial goals. Adjust your portfolio when needed to stay aligned with changing life circumstances and market conditions.

9.2 Keeping Up with Industry Updates and Algorithm Changes

Stay informed about advancements in AI and financial technology. Regularly update yourself about any changes in the AI algorithms used by the platform to ensure you benefit from the latest innovations.

9.3 Integrating AI Tools with Overall Financial Strategy

AI tools are part of your comprehensive financial strategy. Integrate them with other financial planning aspects, such as tax planning, estate planning, and insurance, to achieve holistic financial health.

Section 10: Case Studies: Real-Life Success Stories

10.1 Case Study 1: Achieving Financial Independence with AI-Driven Investment Explore a success story of an individual who used AI-powered investment tools to achieve financial independence and meet their retirement goals.

10.2 Case Study 2: AI-Assisted Retirement Planning for a Comfortable Future Discover how an AI-driven retirement planning tool helped an individual create a sustainable retirement plan and secure their financial future.

10.3 Case Study 3: Building Wealth through AI-Powered Portfolio Management Learn how an investor leveraged AI algorithms for portfolio management to build wealth, optimize returns, and manage risks effectively.

Conclusion:

AI-assisted financial planning tools have democratized access to advanced investment strategies, making it easier for individuals to navigate complex financial markets. By embracing these tools and combining them with human expertise, investors can optimize their portfolios, mitigate risks, and achieve their long-term financial objectives. Remember to stay informed, continuously educate yourself, and use AI-powered platforms responsibly to make the most of your financial journey. With AI as your ally, you can embark on a path to smarter investments and financial security.

Leave a Reply

You must be logged in to post a comment.